Why 5-Year Fixed Big 5 Bank Rates Can Be Risky

Banks love pitching you 5-year fixed rates.

Especially at renewal time.

You’re busy. You’re tired. You want security.

And that shiny low number looks so easy to lock in.

”Just sign, and we’ll take care of the rest!”

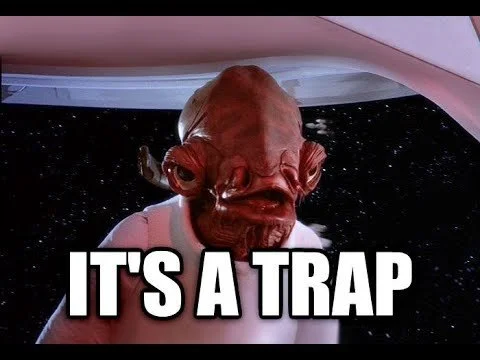

But here’s the truth:

If your life doesn’t line up with that 5-year term?

That sexy-looking rate could become your most expensive mistake.

Let’s break it down.

First, What’s Your 5-Year Plan?

Most people don’t stay put for 5 years.

Life changes. Promotions, babies, divorces, relocations, moving to be closer to aging parents.

Or looking to consolidate any kind of debt that may incur in the next 5 years (new vehicle, renovations, etc).

In fact, studies suggest nearly 2 out of 3 Canadians break their mortgage early - usually by the 3 year mark.

(StatsCan doesn’t publish exact numbers, but every lender will tell you, it’s the norm.) (Source: Canadian Mortgage Trends)

So why are we so obsessed with 5-year terms?

Because banks are - and not just for your benefit.

If your answer is any time less than five years, that perfect rate may turn into a financial trap.

Let’s dive in and figure out where exactly the trap lies.

Closed vs Open Mortgages

Think of Closed vs Open Mortgages just like closed and open relationships…

Closed mortgage = monogamous relationship.

Break it early? There’s a cost. Banks are vengeful exes who want to make it hurt if you try to leave.

Open mortgage = freedom to switch anytime, explore other options, but comes with a higher interest rate.

Most people don’t pick open terms, rates are simply too steep, and unless you have a specific plan on leaving (bridge loan, or expecting to pay out your mortgage soon, etc).

Variable vs Fixed Terms

Variable-rate mortgages come with flexible penalties:

- Always just 3 months’ interest (with the exception of specialty programs - and in which case if you have a good broker, you’d be aware of it (think low rate products that come with strings like only being able to pay out if you sell your home - more on that in another blog post!)

Fixed-rate mortgages are a different story.

If you break a fixed-rate mortgage early, most lenders will charge you the greater of:

Three months' interest, or

The Interest Rate Differential (IRD)

The IRD is meant to compensate the lender for the interest they’ll lose by re-lending the money at a lower rate than what you were paying.

What is Interest Rate Differential? How is it calculated?

Let’s walk through an (extremely simplified, neat) example with a fair lender. Let’s say your mortgage balance is exactly $300,000 today (convenient!). You’re 3 years into your 5 year term, meaning you have 2 years (or 24 months) left, and want to break your mortgage. Your interest rate is 4%, however today’s comparable 2 year rate with the lender is 3%.

The lender’s purpose in charging IRD is to recoup the difference between the interest they would have been able to collect from you at 4% for the rest of your term, and the interest they’ll receive on that exact same 300k over 2 years with a new borrower tomorrow at 3%.

Here’s how it plays out:

| Item | Details |

|---|---|

| Mortgage Balance | $300,000 |

| Original Rate | 4% |

| Current Comparable Rate (2-year) | 3% |

| Difference | 1% |

| Time Remaining | 24 months (2 years) |

| IRD Calculation | 1% × $300,000 × 2 = $6,000 |

So, a fair market lender would charge you $6,000 dollars (still steep), but let’s examine what that looks like with a Big 5 Bank, and how this trap happens.

Jeff explains quickly how penalties can negate and actually leave you worse off than a slightly higher rate with a non-bank lender.

The Big 5 Bank’s secret weapon

So, $6,000 is still steep, but how are we hearing of these $40,000 penalties?

Here’s the bank’s secret weapon - the Posted Rate.

Here’s the thing most borrowers don’t realize until it’s too late with the Big 5 Banks:

You were never supposed to care about the posted rate.

And that’s exactly the problem.

When you’re getting a mortgage, the lender shows you a sweet, low rate, maybe 4% on a 5-year fixed. You feel like you’re getting a deal. You sign, you celebrate, you move in.

The posted rate is the lender’s official, sticker-price mortgage rate, the number they file publicly.

It’s usually 1% to 2% higher than what anyone actually pays, sometimes even more.

Why? Because it makes the discount they’re giving you look generous.

“We knocked 2% off our posted 6% rate just for you. Here’s your 4%.”

You feel like a winner, but it’s a rigged game.

No one actually signs at posted.

It’s too high.

It’s unmarketable.

It’s a number the lender uses for internal math… specifically for IRD.

Back to our previous example, this is what IRD would look like with a Big 5 Bank, same rate, same balance - but now with the added secret weapon of a Posted Rate at 6%.

| Item | Details |

|---|---|

| Mortgage Balance | $300,000 |

| Posted Rate at Funding | 6% |

| Discount Received on Posted Rate At Funding | 2% |

| Effective Rate At Funding (Posted - Discount) | 4% |

| Today's Posted 2-Year Rate | 5% |

| Adjusted Comparable Rate (5% - 2%) | 3% |

| Difference between your original posted rate and today's adjusted rate | 6% - 3% = 3% |

| Time Remaining | 24 months (2 years) |

| IRD Calculation | 3% × $300,000 × 2 = $18,000 |

To summarize, the bank uses the difference between your original posted rate (the rate you ignore while signing on the dotted line) versus today’s adjusted rate - which is posted rate for an equivalent term today (2 years), minus the same discount that you got on your original term.

Real Penalty Examples

Bank penalty spike: After TD/RBC cut posted rates, one borrower’s IRD jumped from ~$5,400 to $22,000 overnight , just because posted rates dropped 1.65%–1.95%

Standard IRD math: On a $500K mortgage with 36 months left, and a 2.54% gap between your rate and current, IRD penalty could hit $38,100.

Big‑5 strong-arming: A $300K mortgage with 2 years left on 3.19% resulted in an $16,800 penalty vs. only $2,400 at a fair‑penalty lender like a monoline

Why Banks Push These Rates

They lock you into a 5-year term, making it hard to switch mid-term

They know you’re less likely to break your mortgage unless absolutely necessary, especially in the first couple years

They profit from your difficulty moving, instead of competing on rate

If that's not a solid reason to shop smarter, I don’t know what is.

🎯 Final Word

That shiny 5-year fixed rate might look stable, but if your life changes early, it can turn into an expensive trap.

Know exactly what you’ve signed up for, including those hidden IRD penalties. Read your commitment throroughly with your mortgage broker to ensure you know exactly what you’re signing up for, and what your vengeful ex bank would do at breakup time - before they’re willing to give you up.

Because flexibility now (not commitment!) might save you thousands later.

Don’t let the banks pressure you into thinking they know what’s best for you - if they aren’t aware of your life plans, their direction can cost you thousands, if not tens of thousands of dollars.

Want to make the correct plan for you and your family and your 5-year plan? Give me a call. Let’s plan together.

Jeff Dinsmore

Mortgage Broker

FSRA # 10315

TMG - The Mortgage Group

519-574-7308