How to Calculate an (approximate) mortgage payment in Canada

You should not need a finance degree to figure out your mortgage payment.

If you know a few simple rules, you can get within about 50 bucks of your real payment in under 30 seconds.

In this post, I will show you:

A simple rule of thumb to estimate your payment

How amortization really works in Canada (and when you can get 30 years)

Why payment frequency makes the math messy

How interest rate and extra payments change everything

Then I will give you an FAQ and a link to a calculator so you can get the exact number

Step 1 - Grab these 3 numbers

To estimate your mortgage payment, you only need three things:

Mortgage amount

How much you are actually borrowing, including any default insurance that gets added on.

Interest rate

Your actual contract rate on the mortgage.

Not the stress test rate. Not a “best rates in Canada” headline.

Amortization

How long your mortgage is scheduled to take to pay off if you make the required payments.

If you know these three, you are not in the dark anymore.

Step 2 - Use this simple “per $100,000” rule of thumb

Let’s start with a quick shortcut.

At common Canadian mortgage rates, your monthly payment per $100,000 of mortgage is roughly:

You do not have to memorize the whole table. Just get used to the ballpark within about 50$ of your actual payment.

Example

Mortgage amount: $500,000

Rate: 5%

Amortization: 25 years

From the table: about $585 per $100,000.

So:

$500,000 × $585

= $2,925 per month

Is that exact? No.

Is it close enough to know if the property is even in the ballpark for your budget? Yes.

Once you have that rough number, you can plug everything into a full calculator to see the exact payment, and the breakdown of principal vs interest.

Next step:

Use our full payment calculator to get the exact number for your situation, including biweekly payments and extra lump sums.

(Insert your calculator link here.)

Step 3 - How amortization actually works in real life

Amortization is just a fancy word for how long you are stretching the loan out.

Longer amortization time = lower monthly payment, but more interest paid over your lifetime. Good for times when affordability is the focus versus paying down the balance being the focus - think maternity leave accommodations, or other times in life where you know you want to rein in spending.

Shorter amortization time = higher monthly payment, but less total interest over your lifetime - good if you’re streamlining and prioritizing paying off your mortgage, and you’re financially able to focus on that goal. Think times when you have dual income and no other real expenses and can still comfortably afford your lifestyle.

Where people get confused is that your amortization does not reset every time you sign a new term. Thankfully too - otherwise we would perpetually have a mortgage - and most people have the goal of paying it off and being debt-free.

If you are renewing with your current lender

Let’s say:

You started at 25 years

You are now 5 years into your mortgage and your mortgage amortization continues and doesn’t restart.

You do not go back to 25. You now have about 20 years left.

Note: The only way to dial back your amortization is by refinancing your mortgage.

If you are switching lenders at renewal

Most of the time, your new lender will use your remaining amortization too.

You are still on the same rough timeline to pay the mortgage off. You are just changing who you owe the money to.

If you are refinancing

When you refinance, you are usually:

Increasing the mortgage size, and

Often stretching the amortization back out, up to 30 years, to keep the payment manageable.

That is why people can sometimes owe more than before, but the payment does not jump as much as they expect.

If you are buying a home

Today’s rules are a bit more flexible than they used to be:

First time homebuyers can now often access up to 30 year amortizations, even on insured mortgages.

Buyers of new builds can also often access 30 years, even if it’s not your first purchase.

Other buyers are usually in the 25 to 30 year range, depending on down payment, insurance, and lender policy. If you have over 20% down, you can access a 30 year amortization as well, however usually come with higher interest since your mortgage is deemed uninsurable.

You do not need to know every rule by heart - honestly, that’s why you have a mortgage broker in your corner. What matters is this:

The longer the amortization, the lower the payment, but the higher the lifetime interest cost.

If you want help choosing the right amortization for your budget and risk tolerance, that is where a broker conversation is worth it.

Step 4 - Payment frequency: why this guide sticks to monthly

In Canada, you can usually pick from:

Monthly

Semi-monthly (twice a month - say the 1st and 16th)

Biweekly (every 2 weeks)

Weekly

Then it gets messy, because some of these can be:

Regular (non-accelerated)

Accelerated

Here is the simple version:

Regular (non-accelerated) payments

Monthly, semi monthly, regular biweekly, and regular weekly all work out to roughly the same total paid per year, just sliced into more pieces.

Your total yearly cost is about the same.

Accelerated payments

Accelerated biweekly or weekly is like saying:

“Take my normal monthly payment, times it by 13, and divide it by 52 (if you’re accelerated weekly) or divide by 26 (if you’re accelerated biweekly)”

TL;DR: Accelerated payments make it so you end up sneaking in about one extra monthly payment per year.

That is great for paying off your mortgage faster.

But it does not line up nicely with simple per $100,000 math.

That is why, in this guide, we stick with non-accelerated monthly payments for estimating.

Once you know the monthly amount, you can use the calculator to convert it to biweekly or weekly and see the exact numbers.

Step 5 - How interest rate shapes your payment

The interest rate does not change how much you borrow. It changes how much you pay the bank for “renting” their money.

At a higher rate:

More of each payment goes to interest

Less goes to actually shrinking your balance

At a lower rate:

Less of each payment goes to interest

More goes to principal

Your payment is set so that, at that rate, you are on track to pay the mortgage off within your chosen amortization.

Even a 1 percent rate change can move your monthly payment by hundreds of dollars on a typical Canadian mortgage. That is why “best rate” headlines are only half the story - the other half is how the rest of your file looks (income, debts, credit, down payment, property type, etc).

Step 6 - Extra payments: the secret weapon

Almost every mortgage lets you make extra payments in one or more ways:

Lump sum payments once a year

Increasing your regular payment

Choosing accelerated biweekly or weekly

Here is the key idea:

Any extra money you throw at the mortgage goes straight to principal.

Once your principal is lower, every future payment has less interest built in.

Example:

Increase your payment by $50 per week

Over time, that small change can cut years off your amortization and save tens of thousands in interest

If you want me to run the exact “what if” on your mortgage, book a call and I will show you exactly how many years you can shave off.

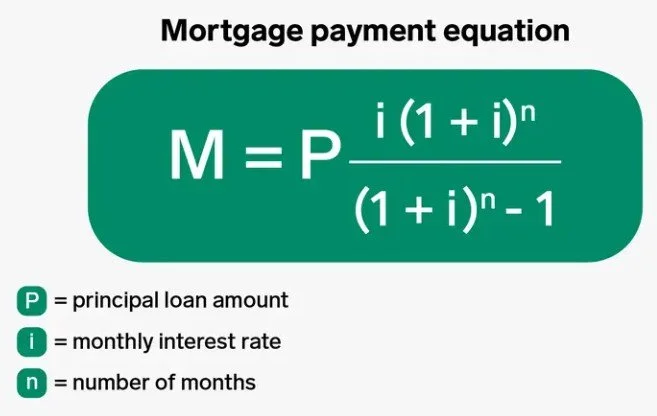

Nerd corner - the real mortgage formula (optional section)

Most people do not need this. But if you like spreadsheets, here is what lenders and calculators use behind the scenes.

The payment for a standard fixed rate mortgage is:

Where:

P = mortgage amount

i = monthly interest rate (annual rate divided by 12)

n = total number of payments (years of amortization × 12)

Or you can just use the calculator and skip the algebra.

FAQ: Common questions about calculating mortgage payments in Canada

1. Should I use my contract rate or the stress test rate for the payment?

Use your contract rate (the rate your lender actually offers you) to estimate your payment.

The stress test rate is only for qualification. It is not what you pay.

2. How do I include CMHC / Sagen / Canada Guaranty insurance in the calculation?

If your mortgage is insured, the insurance premium often gets added on top of your mortgage amount.

Example:

Purchase price: $600,000

Down payment: $60,000 (10 percent)

Mortgage before insurance: $540,000

Insurance premium gets added on top (say it pushes you to about $562,000)

You then use $562,000 as your mortgage amount in the payment calculation.

If you are not sure whether insurance is added to your mortgage or paid in cash, ask your broker. Most people roll it into the mortgage.

3. What payment frequency should I choose?

If you care about simplicity in your budget, monthly or semi monthly is fine.

If you want to pay your mortgage faster without thinking about it, accelerated biweekly is a powerful option because it sneaks in that extra monthly payment each year.

But the “best” choice for you depends on:

How you get paid

How tight your cash flow is

How aggressive you want to be

This is something we can walk through together in a quick call.

4. Does my amortization reset when I renew?

No.

If you started at 25 years and you are 5 years into the mortgage, you have about 20 years left.

Renewing your term does not magically erase those 5 years. You can sometimes adjust your remaining amortization a bit, but it does not reset back to your original start point.

5. How can I check if a property is affordable for me?

Use the rule of thumb in this article to get a quick estimate of the principal and interest payment.

Then remember:

You still need to add property taxes, heat, and condo fees (if any) to get your full housing cost.

Lenders also look at your income, debts, and credit when deciding how much you qualify for.

If you want a full affordability review, send me:

Your income

Your debts

The property price and down payment

I can run the full numbers and show you what a safe payment looks like.

Next step - want me to run your numbers for you?

Reading blog posts is great. But your mortgage is a six or seven figure decision, and really - I don’t want you to base such a big decision on just my blog post.

If you want:

A clear monthly payment number for your situation

Help choosing amortization and payment frequency

Ideas to shave years off your mortgage without blowing up your cash flow

Then book a quick call and I will walk you through it.