Mortgage-Backed Securities in Canada: What Homeowners Need to Know

(And Why Uninsurable Mortgages Come With a Hidden Price Tag)

Ever wonder why two people with similar incomes, credit scores, and down payments can get different mortgage rates?

The answer might have nothing to do with you - and everything to do with how your mortgage is packaged and sold behind the scenes.

Let’s peel back the curtain on Canada’s mortgage insurance system, capital markets, and mortgage-backed securities (MBS) - without the Wall Street jargon.

Wait… What Is Mortgage Insurance?

In Canada, if you buy a home with less than 20% down, you’re legally required to get mortgage default insurance.

It protects the lender (not you) in case you default.

Meaning:

If you aren’t able to make your payments, and the bank repossesses your home

And they take a loss after the sale, legal costs, etc., they can make a claim for that loss through the insurer so they (and their respective investors) can be made whole - and not lose a penny.

The three main insurers are:

CMHC (Canada Mortgage and Housing Corporation)

Sagen (Previously Genworth)

Canada Guaranty

Here’s what most people don’t realize:

Only CMHC is directly backed by the federal government.

But Sagen and Canada Guaranty? They’re private insurers, yet 90% of their losses are covered by the government.

So while they’re technically not government entities, they’re pretty darn close when it comes to risk protection.

You pay the insurance premium, but in return, lenders give you access to their best rates - because your mortgage is now “safe money” in their eyes.

No matter what you do, they get paid (and so do their investors).

The Most Desirable Loan in Canada: The Insured Mortgage

These are the gold standard for lenders and investors.

Why?

Because they’re guaranteed by the government, or nearly all guaranteed. If you default, the insurer pays the bank back. Zero risk.

That makes them perfect to bundle up and sell off as part of a Mortgage-Backed Security (MBS).

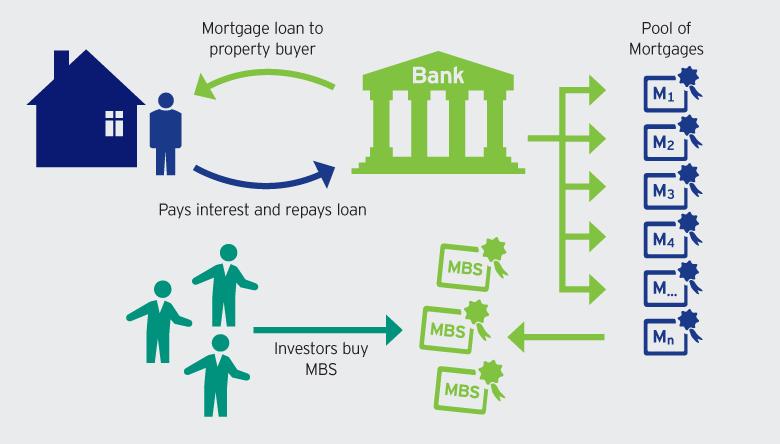

Think of it like this:

The lender gives you a loan.

That loan is insured by one of the three big insurers (completely or almost all backed by the GoC)

The lender sells your mortgage (along with others) to investors in a bundle called a mortgage backed security (MBS). The process in which they do this is called securitization.

Investors get steady returns.

Everyone wins.

Insurable Mortgages and Bulk Insurance

Now let’s say you put 20% or more down. You don’t have to get insurance.

But lenders still want to sell that loan - and investors still want it insured.

Enter: bulk insurance.

This is when lenders insure your mortgage themselves, behind the scenes, as long as it fits certain criteria.

It’s still with the big 3 insurers. Except this time, you haven’t outright bought the insurance for them.

The cost of this insurance gets baked into your rate. That’s why:

Insurable mortgage rates are usually slightly higher than insured ones

But still lower than uninsurable loans

So... What’s an Uninsurable Mortgage?

If your mortgage can’t be insured - either individually or through bulk insurance - it’s uninsurable.

This doesn’t mean it’s “bad.” It just doesn’t qualify under the insurance rules.

Common reasons:

You’re refinancing a home

Your amortization is longer than 25 years

The property value is too high (over 1.5M) - weird to think about, but homes that are more expensive are often also harder to sell

The home type is non-standard (Think a modular home in a trailer park, cottages that have untreated lake intake water)

You're purchasing a rental property

And here's where it gets juicy...

Uninsurable loans can’t be sold into government-backed MBS pools. That means they’re harder to offload, carry more risk for lenders, and you’ll often pay a higher rate as a result.

But wait - there's more.

The Rise of Private-Label RMBS in Canada

In the U.S., the 2008 crash was caused by the reckless bundling of high-risk mortgages into securities that were sold off to investors.

Canada didn’t go down that road. Our system is tighter, safer, and more regulated. Hence why we were insulated from the 2008 events.

But in the last ~10 years, a new player has entered the game: private-label RMBS (Residential Mortgage-Backed Securities) - not unlike the Private-label RMBS highlighted by the Big Short.

These are securities backed by uninsurable mortgages - no CMHC guarantee, no government safety net. Higher risk, but at the end of the day, these loans are still on the traditional side, and relatively low risk when bundled all together - what was happening in 2008 is that loans were getting tossed in to “feed the beast” of MBS in the USA, even private-level loan riskiness were bundled and sold as AAA. Not the case here in Canada, thankfully - but interesting to consider how this all fits.

Who’s Doing It in Canada?

MCAP kicked things off in the early 2010s

TD Bank followed in 2020 with a $700M private-label RMBS

Other lenders are testing the waters

Since they’re not backed by the government, investors demand higher returns - and that trickles down to you, the borrower, in the form of higher interest rates. Hence why a refinance of your home yields higher rates, than if you were just to transfer the balance at renewal.

Pop Culture Bonus: What The Big Short Got Right

Want to see how this all works - without falling asleep?

Watch the Jenga scene from The Big Short. It explains how risky mortgages get bundled and sold off - and why that was a ticking time bomb in the U.S.

PS: HIGHLY recommend this movie - incredible cast, and very well-done in explaining mortgages, mortgage-backed securities and where things went wrong in 2008.

Canada isn’t the U.S., but private-label RMBS are worth paying attention to - especially if your mortgage is uninsurable.

Here’s how I’d sum it up:

If your mortgage isn’t insured, and can’t be bulk insured, chances are it’s being packaged into one of these private pools - and you’re footing the bill through higher rates.

Final Thoughts

Behind every mortgage rate is a whole financial system you never see.

Insured loans are the safest - and usually cheapest rate-wise (minus the cost for the insurance being tacked to your loan, of course)

Insurable loans ride close behind

Uninsurable loans come with higher rates - because they’re riskier for everyone involved, as they aren’t backed by the government in some way, shape or form, and also don’t fit into specific molds - the borrowers could be AAA, but the house doesn’t fit the standards, or the income is a bit unique but the property fits all the requirements, etc.

Understanding this isn’t just trivia - it helps you make smarter mortgage decisions.

Want a better rate? Start by knowing where your mortgage fits.

Book a call and I’ll walk you through the best options - if you were previously insured, let’s do what we can to keep that insurance going!

Or send me your mortgage details and I’ll tell you exactly what you're eligible for - no fluff, just facts