The Kawartha and Libro Credit Union Merger: What It Means for Ontario Mortgages

Ontario just got a financial powerhouse

If you're a mortgage shopper, broker, or credit union member in Ontario, something big is happening.

Kawartha Credit Union and Libro Credit Union just announced a plan to merge.

Combined, they’ll form an $11 billion financial giant with 180,000 members, over 57 branches, and one mission - to serve Ontario better.

But what does that mean for you?

Let me show you.

Libro CU and Kawartha CU’s merger announcement image on their website. As they state: “Forward, together isn’t just a phrase - it’s how we’ll get there”.

This isn’t just a merger - it’s a strategy

This isn’t some last-ditch survival move. This is two high-performing, community-first credit unions with similar visions, strong balance sheets, and loyal member bases deciding to scale up.

Why?

So they can…

Offer more products

Deliver better mortgage rates

Reach more communities

Strengthen their digital tools

Compete head-to-head with big banks

From a mortgage broker’s perspective, this merger isn’t just welcome - it’s a win.

I’ve worked with both.

Here’s what you should know.

I’ve partnered with both Kawartha and Libro over the years. And I’ll tell you this:

They’ve always been efficient, transparent, and focused on doing what’s right for the member.

Now imagine that level of service, but with double the footprint and more leverage in the mortgage space.

Brokers get:

More flexible lending options

Faster turnarounds

Broader product range

Clients get:

Better access

Better rates

More solutions

That’s how you win in today’s market.

Here's what most people miss about mergers like this

When people hear “merger,” they often worry.

Will my branch close?

Will rates go up?

Will it feel like a bank?

But let’s zoom out.

The last 10 years tell a different story:

Libro grew through smart, member-friendly mergers (United Communities, Hald-Nor, Kellogg CU).

Alterna absorbed multiple credit unions and kept improving digital tools and branch access.

PACE CU faced a different fate, but their merger into Alterna brought long-needed stability.

Done right, mergers make credit unions stronger.

Stronger means:

More stability for members

Bigger mortgage approval limits

Better online tools

More locations across Ontario

This isn’t a sellout. It’s a scale-up.

Why now?

Rates are higher. Lending rules are tighter. Margins are thinner.

And the cost of staying small? It’s going up.

Libro and Kawartha aren’t reacting to pressure. They’re getting proactive. They’re making sure their members - and mortgage brokers like me - have every tool needed to succeed in a tougher market.

In fact, the merged credit union will be better equipped to:

Offer competitive mortgage solutions for first-time buyers, refinancers, and investors

Handle larger mortgage files across the province, including larger commercial mortgages which benefits development in both areas

Invest in tech that speeds up every part of the mortgage process. Libro and Kawartha are already some of my favorite credit unions to work with, so I’m really excited to see what they do together.

More scale means more power. And that power gets passed on to you.

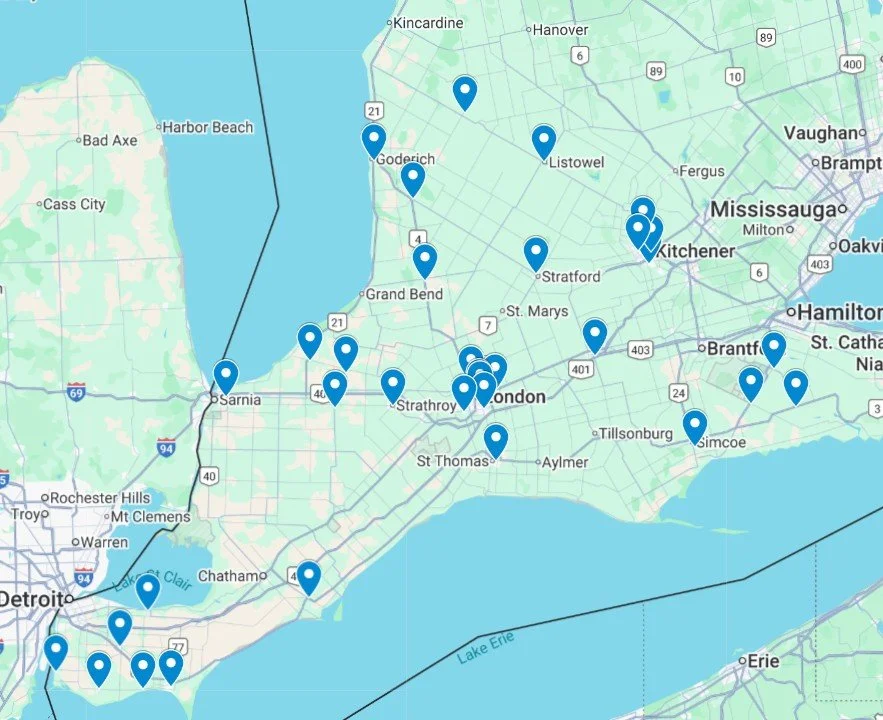

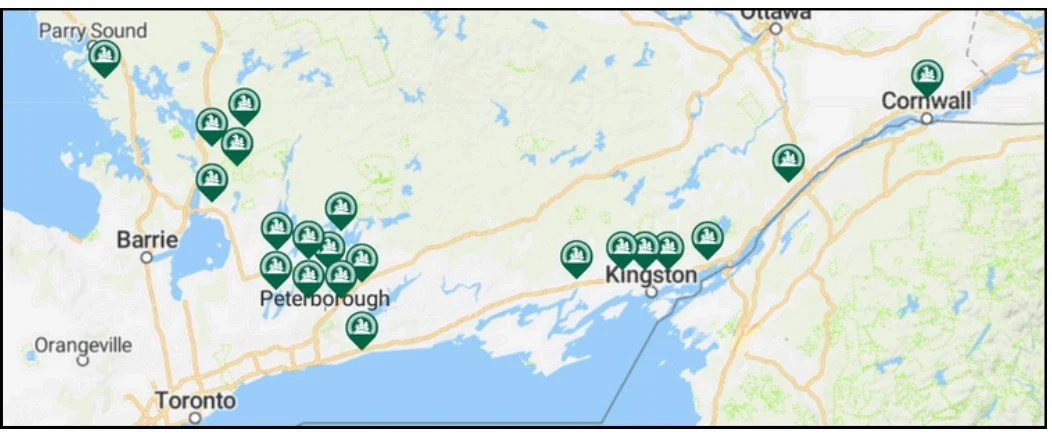

Visualizing the opportunity: The Ontario credit union corridor

From Peterborough and Bancroft to London and Windsor, this merger connects two massive zones of Ontario.

This east-west corridor brings service to more rural towns, more small cities, and more urban mortgage clients than ever before.

Map of all Libro Credit Union Bank locations

Map of all Kawartha Credit Union locations

Whether you’re in cottage country or the heart of Southwestern Ontario - they’ve got you covered.

What happens next?

Here’s the timeline:

Summer 2025: Regulatory review with FSRA

Fall 2025: Member vote across both credit unions

Jan 1, 2026: If approved, the merger takes effect

No surprises. No pressure. Just progress.

Of course, there will likely be growing pains as the two Credit Unions amalgamate, but give it some time and the new and improved credit union will surely be stronger and an even more competitive lender in the market - and I’m SO excited to see where things go with these market-leading Credit Unions to begin with.

Final thought: This is good news

If you’re a member of either credit union, get excited.

If you’re a homebuyer, take note.

And if you’re a mortgage broker like me?

Start getting ready.

Because when this merger goes through, you’ll have access to more products, stronger service, and a credit union partner built to go the distance.

I’m looking forward to it.

And I think you should be too.

Want help navigating your mortgage with Libro or Kawartha?

Reach out today.

Get expert advice on how to leverage this merger to your advantage.

Jeff Dinsmore

Mortgage Broker

FSRA # 10315

TMG - The Mortgage Group

_________________

Related articles:

The Globe and Mail: Kawartha and Libro Plan to Go Forward, Together

The Canadian Press News: Kawartha and Libro Plan to go forward, together

KawarthaNow: Kawartha Credit Union and Libro Credit Union announce plans to merge as of January 1, 2026