How Mortgage Interest Works (Explained Like You're Melting Ice)

If you’ve ever wondered why your first few mortgage payments barely make a dent - even though they feel massive - you're not alone.

Let’s break it down using one simple image: a giant block of ice.

Your Mortgage Is a Block of Ice

Imagine your mortgage is a huge block of ice. Like, taller-than-you, hard-as-rock, heavy-as-heck kind of ice.

Each time you make a mortgage payment, you’re chipping away at that block. But the air around it? That’s interest - and it’s keeping the ice from melting fast.

Why Interest Is So High At the Start

At the beginning of your mortgage, the ice block is huge - because your loan balance is huge.

The bigger the block, the more freezing cold air (interest) it gives off.

That’s why most of your early payments feel like they’re going nowhere. A big chunk of your money goes toward interest - just to keep the block from growing. Only a little bit actually chips away at what you owe.

But as you keep paying down the mortgage?

The block shrinks.

Less surface area = less interest buildup = more of your payment goes toward principal.

Want to Pay Less Interest? Melt It Faster

If your mortgage is a block of ice, here’s how to bring the heat:

Lump sum payments go straight to principal. Think of it like aiming a heat lamp — the block melts faster, and less interest forms.

Boost your regular payments. Even a small increase speeds up the melt and cuts down on long-term interest.

But heads up: most lenders cap how much extra you can pay each year without penalty.

Your limit usually resets every anniversary year (for example, if your mortgage funded on July 1, your window runs July 1 to June 30). Go over your limit, and you'll trigger a penalty.

Why? From the lender’s perspective, you're disrupting their expected cash flow. You’re not paying off the full mortgage — but it’s close enough that their investors start raising eyebrows.

Want to learn more about the mysterious investors? Read my blog post on Mortgage-Backed Securities here.

Most lenders allow:

Up to 20% of your original mortgage as a lump sum per anniversary year

Up to 20% increase on your regular payment annually

Some allow less — 15% or even 10%.

If you’re expecting a big windfall (inheritance, bonus, lottery ticket?), double-check that your mortgage gives you enough room to drop that cash in penalty-free.

Why Amortization Affects Interest

The longer your amortization (that’s how many years your loan is spread over), the slower the melt.

Longer amortization = smaller payments = more time = way more interest paid over time.

Shorter amortization = bigger payments = faster melt = less total interest.

It’s all about how quickly you want that block gone - and what you’re willing to do to make it happen.

(For nerds like me) How interest works on paper (with a real amortization table to boot!)

Carrying on with the example of the ice block - you’re paying a ton of interest at the start of your mortgage by design. Your first payment will literally be the first payment on the largest your mortgage will ever be (unless you refinance - which restarts the timer to whatever you set your amortization).

Your first chip off the block? The biggest your block will ever be.

Let me break it down with a non-H2O based example, with real figures…

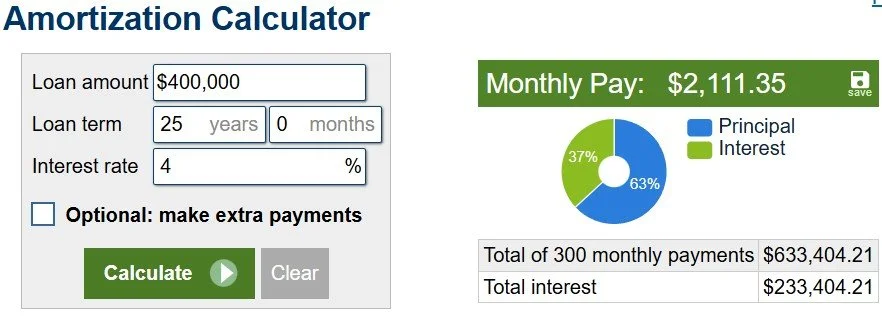

For argument’s sake, let’s say your interest rate is a constant 4% for the full 25 year amortization of your $400k mortgage.

(Yes, I know - this isn’t really plausible. Stick with me though - because as long as you’re following your amortization, the only thing that changes is how much goes to interest. Interest rate goes up? So does your payment - to accommodate that increase in interest. Interest rate goes down? So does your payment - but you’re still paying off your mortgage at the same rate…unless you do something about that by paying off more than expected - So just stick with me as I go through the constant interest rate example that wouldn’t happen in real life).

Mortgage tools like Calculator.net ‘s amortization calculator is a great way to visualize your mortgage life span.

So you can see above that this mortgage layout has its fixed monthly payment of 2100 and change, where close to 2/3 of your mortgage payments over the lifetime of your mortgage went to principal, and a little over 1/3 of your payment went to interest.

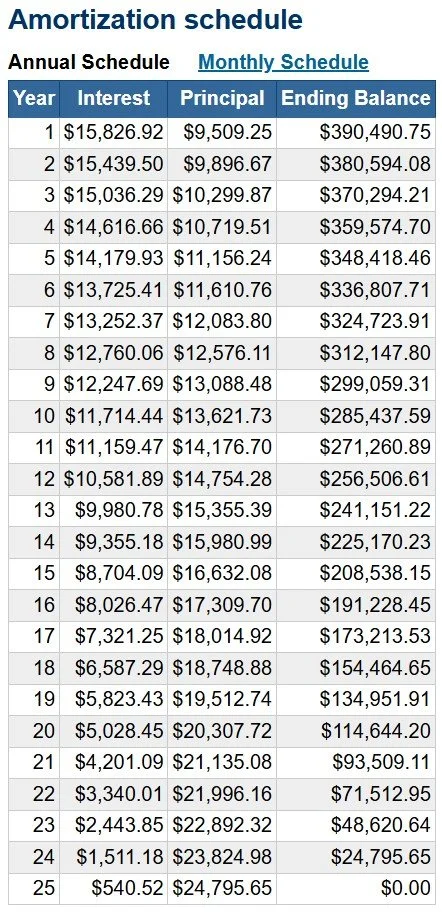

And here you see your ice block, in real time.

Each year, you chip away at your ice block.

At first it’s mostly interest, as discouraging as that may be.

However as you continue to pay it down, your principal balance shrinks. Therefore the interest charged on that principal also shrinks - so your constant payment of 2100 and change starts to skew from being interest-heavy, to focusing on principal.

Notice how in year 8, things start to even out? About 50/50 principal and interest?

Once you reach that break even point, you know you’re making progress.

Peep the last few years of your mortgage - hardly any interest charged, and see how quickly a rather large balance is paid down (relative to the first few years, of course!).

So, at the end of the day - don’t feel discouraged. That break even point is the light at the end of the tunnel.

Want to reach that break even point that much faster? Get your heat lamp ready, and make some lump sum payments, or add an extra $ 50, $ 100, or $ 200 to each payment to speed up the melt.

Take that, interest!

Final Thoughts

Interest isn’t a punishment - it’s just what happens when your mortgage ice block is still big.

But you’re not stuck.

Every extra dollar you throw at your mortgage is like turning up the heat.

Want help building a melt plan that actually works for your goals?

📍 Book a free call and we’ll map out how to save thousands in interest 📍 Or send me your current mortgage info and I’ll run the numbers - zero pressure, just real answers.