Mortgage Tips & Real Advice for Canadian Homebuyers

Everything Canadian homebuyers, investors, and refinancers need to know - straight from a licensed broker.

Recent Blog Posts by Jeff Dinsmore, Mortgage Broker:

Read more blog posts below:

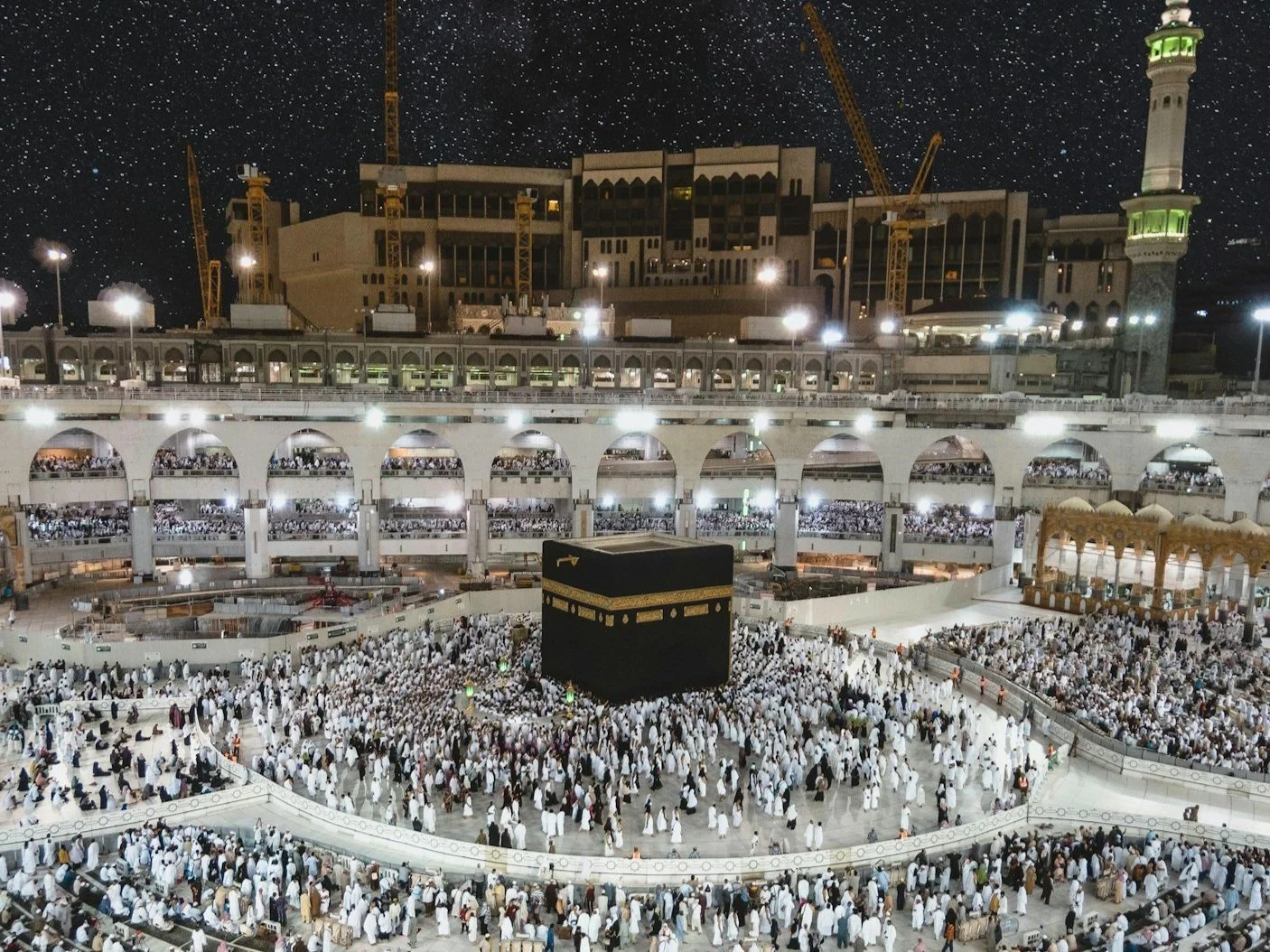

Are Mortgages Haram? What Muslims in Canada Need to Know

Wondering if mortgages are haram? This post breaks down Islamic views on interest, how halal mortgages work in Canada, and what options are available for faith-conscious buyers.

Explain Like I’m 5: How Do Mortgages Work?

What does a mortgage have in common with a $50 bike, a $5 down payment, and your weekly allowance? Everything. We explain mortgages in the simplest, most entertaining way possible - perfect for first-time buyers and confused grownups alike.

Are Mortgages Assumable in Canada? Here's the Ugly Truth

Assumable mortgages sound genius - take over a seller’s low rate and save thousands. But in Canada, most lenders make it nearly impossible. Discover why assumptions fail, what lenders don’t want you to know, and smarter ways to lower your mortgage costs today.

7 Smart Questions Every First-Time Homebuyer Should Ask - And My Unfiltered Answers

A first-time buyer asked me 7 smart mortgage questions. I answered them all - and added the ones you should be asking too.

Mortgage brokers are usually free for clients, but lenders pay us for sending them qualified deals. Here’s how broker commissions work, when fees apply, and why banks actually prefer paying brokers over finding clients on their own.